ScandiNAVIAN Fixed Income

Relative Value

Arbitrage

We offer professional investors diversification through resilient portfolios designed to excel in an ever-changing global landscape.

We offer professional investors diversification through resilient portfolios designed to excel in an ever-changing global landscape.

A trusted strategy designed to deliver exceptionally attractive risk-adjusted returns while benefitting from a declining risk profile.

Our CABA Flex funds provide investors with an excellent 3-year investment opportunity. In addition to offering attractive returns, I’m particularly pleased with the declining risk profile, which provides peace of mind. These funds are launched strategically when yield spreads are most favorable, ensuring optimal timing for maximum profitability.

Mette Østerbye Vejen

CEO

Founded in 2016, CABA Capital is a leading Danish hedge fund manager specializing in fixed-income strategies. Our reputation is built on the strength of our exceptional team, best-in-class mindset, and quantitative excellence.

Our investment solutions are rooted in empirical evidence and rigorous back-testing, tailored to diversify and strengthen portfolios for professional investors.

Leveraging our Scandinavian home advantage, extensive experience, quantitative proficiency, and robust institutional infrastructure, we aim to deliver superior risk-adjusted returns while upholding exemplary governance and responsible conduct.

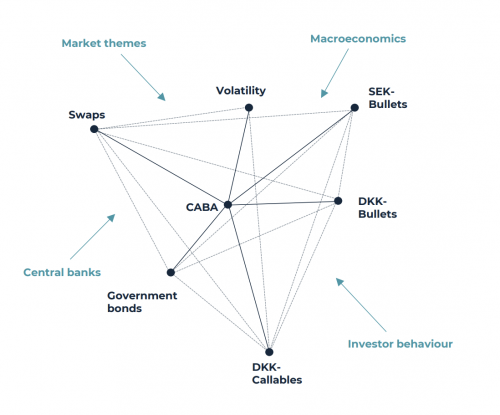

Our investment strategies focus on the Scandinavian bond market, with arbitrage techniques and relative value analysis of low-risk Scandinavian spread premiums at the core of our approach.

Leveraging our deep knowledge of the Scandinavian markets, economic conditions, and political landscape, we enjoy a significant home advantage.

Our expertise and dedication to quantitative precision provide us with a comprehensive understanding of the factors influencing Scandinavian bonds, enabling us to make informed investment decisions and capitalize on opportunities others may overlook.

We are powered by a team of industry-leading professionals who bring expertise, innovation, and insight to every corner of our operations.

Our people are our greatest asset, fostering a culture of excellence, collaboration, and continuous growth.

We uphold the highest standards in every aspect of our work, driven by a relentless pursuit of quality and performance.

Our mindset ensures that we deliver value, meet investor expectations, and continually raise the bar.

Our in-depth expertise in the Scandinavian fixed income markets allow us to identify and confidently act on opportunities.

With a clear understanding of market dynamics, we make informed investment decisions and capitalize on opportunities others may overlook.

Our approach is rooted in rigorous quantitative analysis and relentless back-testing, allowing for informed, data-backed decisions.

With quantitative proficiency, we aim to deliver superior risk-adjusted returns to professional investors.

Transparency has been a core value for us from the very beginning. We are committed to providing clear, timely, and complete information at every step.

Our commitment to open communication fosters trust and ensures that investors always have a full understanding of their investments.

Through strategic risk management and comprehensive risk assessments, we build and manage resilient portfolios that thrive in an ever-evolving world.

By employing a data-driven approach to risk, we effectively seize market opportunities while maintaining disciplined risk exposure.

At CABA Capital, we understand the critical role the financial sector plays in driving the green transition through strategic investments and financing. We are committed to responsible investing and adhere to strong management principles.

Environmental, social, and governance (ESG) factors are integral to our approach, influencing decisions across all initiatives within our firm.

We believe that investing in sustainable countries with democratic governance, respect for human rights, and a commitment to social and environmental well-being not only fosters positive impact but also delivers superior returns and mitigates risks.

At CABA Capital, we are fully committed to the success of our investment strategies. We co-invest our personal capital alongside our clients, reflecting our unwavering confidence and ensuring a complete alignment of interests.

Whether you’re interested in exploring partnership opportunities or learning more about our investment strategies, we invite you to get in touch with us.

Additionally, you can register here to receive monthly performance updates and notifications on upcoming fund launches.