Three-Year Investment Fund

CABA Flex2 has a lifespan of 3 years after which returns are realized and investors receive their capital.

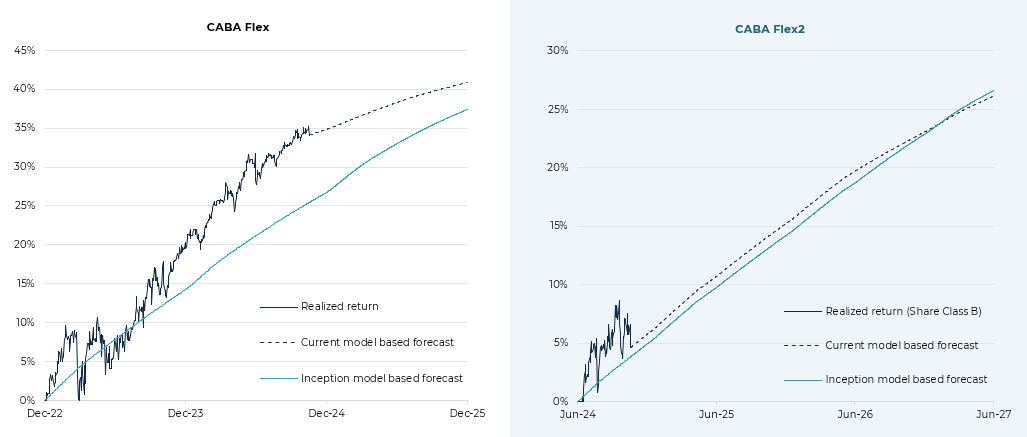

Expected Return of 25-30% over three years

Returns are generated by exploiting the interest rate difference between Scandinavian mortgage and government bonds. The expected return is after fees.

Proven Strategy

Our first CABA Flex fund serves as a solid proof of concept. The new fund, CABA Flex2, follow the same investment strategy.

Scandinavian Bonds

AAA-rated Scandinavian bonds offer the lowest default risk. The stability of the region's economies makes Scandinavian bonds a low-risk asset.